|

pet insurance companies in az: what I learned before enrollingStarting from zero, as a first-time userI wanted something that would actually help when vet bills spike, not just look good on a quote page. I also wanted flexibility because my dog and I bounce between Phoenix trails, neighborhood walks, and occasional road trips to Sedona. I learned that most pet insurance companies in AZ offer similar core coverage - accidents and illnesses - but the fine print quietly changes the value, sometimes a lot. Arizona-specific things I paid attention to- Heat risks: Heatstroke, burned paw pads, dehydration IVs. I checked if ER exam fees are covered, because summer emergencies often start there.

- Desert hazards: Rattlesnake bites and antivenin (pricey), cactus spines, scorpion stings. Treatment is typically covered; training or vaccines usually aren't.

- Valley fever (coccidioidomycosis): Common around Phoenix and Tucson. I looked for coverage of diagnostics, chest X-rays, and long-term meds like fluconazole.

- Hiking injuries: Foxtails, torn nails, soft-tissue strains. Plans that include rehab, acupuncture, or laser therapy can be quietly valuable.

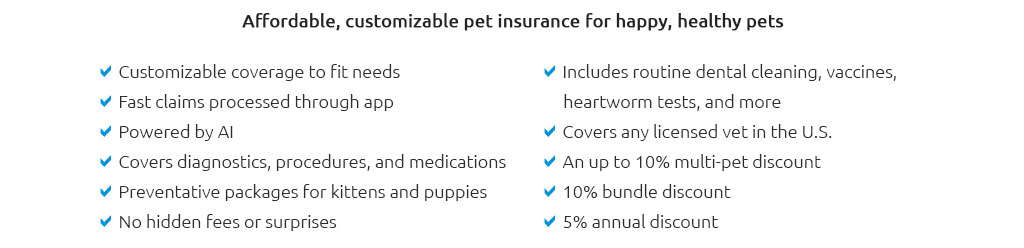

How companies differ (and why it matters)- Reimbursement style: 70% - 90% after deductible. Higher reimbursement raises premiums but cushions big surprises.

- Deductible type: Annual vs. per-condition. Annual felt simpler for me; per-condition can be cheaper if your pet rarely gets repeat issues.

- Annual limits: From $5k to unlimited. I leaned higher because ER visits in AZ can add up fast.

- Waiting periods: Accidents often a few days; illnesses ~14 days; cruciate ligament issues can be months. I set reminders so I wouldn't assume day-one coverage.

- Exam/ER fees: Some include them, others make it an add-on. This small checkbox can be the difference between "covered well" and "almost."

- Prescription meds: Ongoing meds for valley fever or allergies - verify they're reimbursable.

- Dental illness: Not just accidents. Gum disease or extractions may need a special clause.

- Behavioral care: Useful for anxiety-sensitive dogs during monsoon storms, if included.

- Claim speed and direct pay: A few can pay vets directly; otherwise you pay and get reimbursed. Fast app claims are a quiet sanity-saver.

Price and value, not just costQuotes shift by ZIP code, breed, and age. Phoenix can price differently than Flagstaff. I compared the "monthly comfort" of a higher deductible and 80% reimbursement versus the "sleep-better" feel of unlimited coverage - both reasonable, just different tradeoffs. My quick comparison framework- Shortlist 3 - 5 companies licensed in AZ and pull the same-day quotes for your ZIP.

- Match settings: the same deductible, reimbursement, and annual limit for a clean comparison.

- Scan exclusions: cruciate/IVDD waiting periods, bilateral issues, dental illness, prescription diet limits.

- Check if exam and ER fees are included or an add-on.

- Ask support about valley fever coverage and typical claim timelines in AZ.

- Read the sample policy (yes, the PDF) for look-back periods and claim filing deadlines.

- Do a quick math test on a $2,000 ER bill with your settings. If the number feels fair, you're close.

Real-world moment that made the value clickOn a Saturday morning at South Mountain, my dog stepped into a cholla patch. The urgent care visit plus meds hit $280 - not catastrophic. But a month later he ate half a sock (apparently delicious), and the ER bill reached $1,950. With an $500 deductible and 80% reimbursement, I received roughly $1,160 back. I could breathe again, and it felt like the plan did exactly what it promised - quietly, efficiently. Common gotchas I almost missed- Bilateral exclusions: If one knee has an issue pre-policy, the other knee may be excluded later.

- Cruciate waiting periods: Often months; some allow an orthopedic exam to shorten it.

- Annual vs. per-incident deductibles: Easy to assume; hard to correct after a claim.

- Wellness add-ons: Convenient, but they may not "save" money; they do help with budgeting.

- Age limits: Enrollment cutoffs for new policies; keeping continuous coverage matters.

- Recheck fees: Covered only if exam fees are included.

If you want to keep premiums in check- Start before chronic conditions appear; underwriting is kinder.

- Pick a higher deductible with a strong annual limit for big-event protection.

- Pay annually to avoid billing fees, if cash flow allows.

- Use tele-vet features for triage; save ER visits for true emergencies.

- Desert hacks: booties on hot pavement, carry water, snake-avoidance training (not covered, but protective).

Final thoughtComparing pet insurance companies in AZ took me a weekend, but it turned anxiety into a plan. Not every perk will matter for every pet, of course, yet the right mix - solid emergency coverage, clear exclusions, and reasonable claim speed - delivers real, day-to-day value. I felt better leaving the house, and my budget did too.

|

|